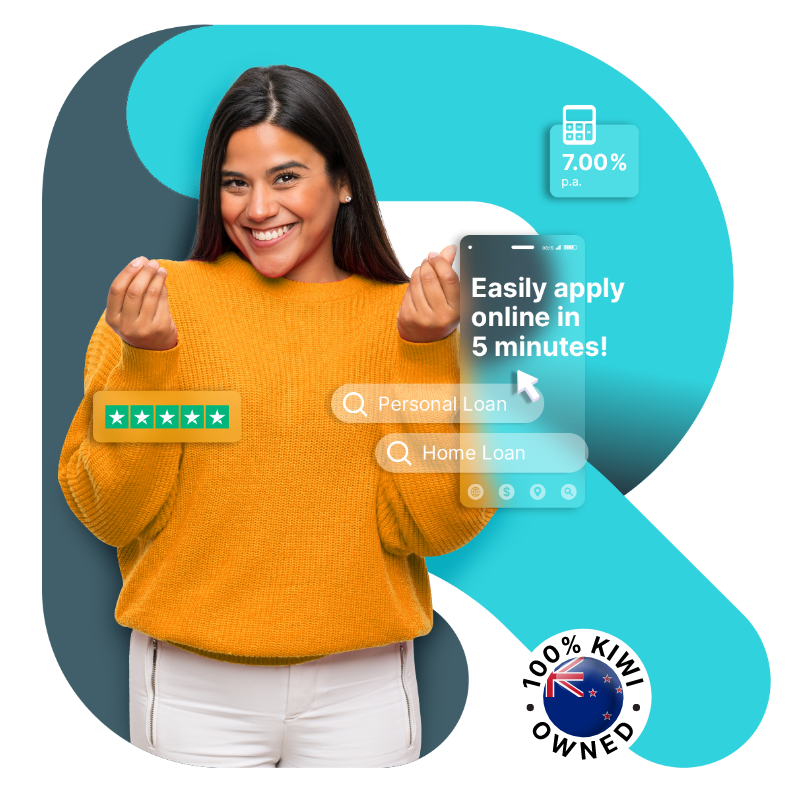

Lending made simple.

Unlock the power of lending, with a great rate and fast approval process. Get a loan now from 7% p.a.

RATES

from 7%

NZ OWNED

and operated

RANGE OF LOANS

to fit your needs

Flexible and quick

Navigating the world of personal loans, home loans, vehicle loans and debt consolidation loans can be overwhelming – but don’t worry, we keep it simple! With the help of our loan specialists, you can secure a loan from 7% p.a. the Lending Room make it happen!

What you need

- Be 18 years or older

- Receive a minimum of $600 weekly

- Valid Passport or NZ Drivers Licence

- Internet banking access

- A few minutes to apply online

Our range of Loan Products

Whether you are needing a loan for a holiday, to consolidate debts or purchase your first home, we can help. You don’t even have to leave the couch, applying is easy, with our simple online application!

Personal Loans

We will create a personalised loan for you from 9.95% p.a. for those unexpected life events.

Debt Consolidation

Tired of juggling debt?

We help you take control of your finances with one easy repayment.

Vehicle Loans

We make applying for vehicle finance simple so you can buy that car, motorbike, boat, jetski or motorhome.

Unsecured Loans

Unsecured loans from $1,000 to $50,000. We make applying for unsecured loans simple. Apply for an online loan today.

Home Loans

Buying a home is exciting! Whether you are buying your first home, an investment property or simply refinancing, apply online today

Business Loans

Personalised lending solutions for your business. If you are looking to buy Plant and Equipment or just require working capital, let’s chat!

Customer feedback

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

EXCELLENT | Rated 4.9 based on 314 reviews

Frequently asked questions

- You need to be at least 18 years old

- Valid Photo ID:

- A NZ Citizen, Resident or hold a valid work visa

- Receive a regular source of income of $600 weekly or more, this can be through employment or a Government benefit.

Yes, if your Work Visa is valid for a minimum of 12 months you are eligible to apply. The loan term would be limited to the expiry date of your Visa and security may be required, for example a freehold vehicle. To discuss your personal circumstances, please give us a call.

Our trusted

Finance Partners

Our trusted Finance Partners